Lending Club Update: Returns Increasing Above 10% As Higher Risk Loans Stay Current: Bible Money Matters |  |

- Lending Club Update: Returns Increasing Above 10% As Higher Risk Loans Stay Current

- So Many Retirement Account Options, So Little Time (And Post Roundup)

- 4 Ways In Which We Are Typically Overinsured

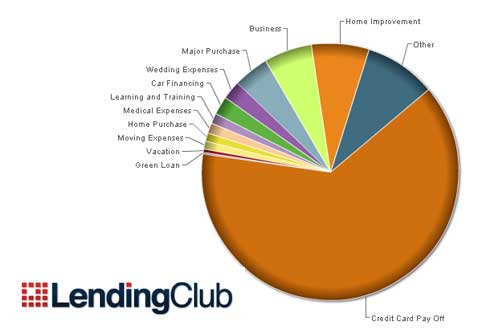

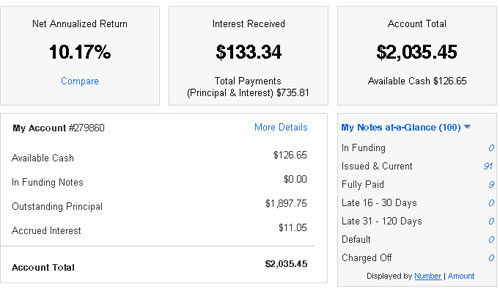

| Lending Club Update: Returns Increasing Above 10% As Higher Risk Loans Stay Current Posted: 05 Apr 2011 05:38 AM PDT I've been investing in Lending Club for quite a while now and I’ve been pretty happy with how well it has performed. To be honest it has done better than my expectations. My returns are better than what I would get in a a high yield savings account, while at the same time helping others to get loans at lower rates than they would get at a traditional bank or via a credit card. It's a great way to consolidate higher interest debt. Peer to peer lending is only going to get bigger from here I think. Check out my original Lending Club review and my post on my Lending club investing strategy. It’s been about 3 months since I did an update, and I thought now would be a good time to do an update on my riskier lending strategy that I’ve implemented in the past 5-6 months. Lending Club Returns Above 10%So here's a quick look at the returns I’ve been seeing lately

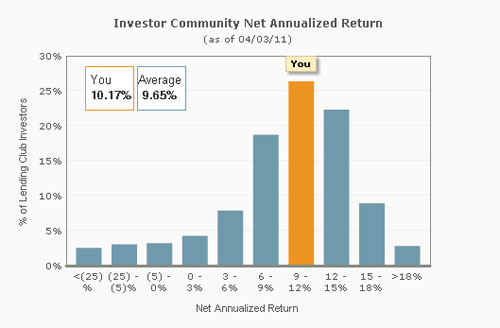

So my strategy of adding a few choice hand picked and riskier loans seems to be paying off as I’m seeing my returns increase from where they were 6 months ago. Low Grade Loans Can Have Good ReturnsMy returns that I’ve been seeing are slowly improving as I’ve taken on a new investing strategy suggested by Matt at steadfastfinances.com. He started a Lending Club investing club where he sends out hand picked high risk loans every month by email. He invests in lower grade borrowers who he has deemed to be acceptable risks. The loans he chose were Grade C or D for the most part, and while their credit scores weren't necessarily the best, Matt felt that they were acceptable investment risks because they all had good professions, solid job history and security, and good payment histories. Over the last 5-6 months I've been using this strategy to see if I can get my net annualized return up above 11-12% based off of his suggestions in his Lending Club investing club. So far I've gotten my returns to rise from somewhere around 8.5% up to where it is now above 10.17%. So I’m slowly inching towards that 11-12% I was shooting for. Who knows, maybe one day I'll be near the 14.11% Matt is currently seeing. It should be noted that Matt has now had several defaults on his loans and is adjusting his strategy a bit. Luckily I haven’t had any defaults, in part I think because I cherry picked only higher income borrowers from his suggestions. Here's where my NAR stands now, slightly above average. I hope to move up a couple of columns there: Lending Club StrategyMy strategy I used in the past for Lending Club, and the strategy I'll still be using to some degree:

So that's the basic strategy that I'm using to invest in Lending Club right now. What strategy are you using to invest? I'm curious to know what is and isn't working for all of my readers. Not ready to invest, but looking to consolidate debt or pay off a high interest credit card? You might want to consider borrowing from Lending Club. Check out my post on borrowing from Lending Club. Are you currently investing in Lending Club? How are your returns looking? Tell us in the comments! This article was written by Peter Anderson. Peter Anderson is a Christian, husband to his beautiful wife Maria, and father to his baby boy, Carter. He loves reading and writing about personal finance, and also loves a good board game every now and again. You can find out more about him on the about page or check out his design site at http://www.logosforwebsites.com. You can also follow him on Twitter at @moneymatters. Copyright © Bible Money Matters - please visit biblemoneymatters.com for more great content. Related Posts |

| So Many Retirement Account Options, So Little Time (And Post Roundup) Posted: 04 Apr 2011 01:28 PM PDT Over the last couple of months I’ve been reading up on a lot of different investment account option choices – everything from discount online brokers to mutual fund companies and everything in-between. There are so many options out there that it can be easy to be overwhelmed with all the choices, and to just not make a decision. I think I’ve been near or at that point for a while now, and while I’ve done some investing through the 401k at my work, I’m now looking to invest outside of that a bit because there is no longer a company match and we’d like an account with less expense and a few more options. We’re also done saving up our 10 month emergency fund, and we’re secure enough that we can just start socking away money to invest now. After doing a ton of research I’m leaning towards opening Roth IRAs for us both at Vanguard before tax day, and getting into some of their low expense target retirement funds as our main retirement vehicle. I also may open an account at Betterment.com, and invest a small amount of money there just to see how it works as well. Because the account has higher fees, however, I won’t be making that my sole retirement vehicle. So what advice do folks out there have for someone who will be venturing outside of a company 401k for the first time in a long time? Links This WeekHere are some of my favorite posts of the week.

This article was written by Peter Anderson. Peter Anderson is a Christian, husband to his beautiful wife Maria, and father to his baby boy, Carter. He loves reading and writing about personal finance, and also loves a good board game every now and again. You can find out more about him on the about page or check out his design site at http://www.logosforwebsites.com. You can also follow him on Twitter at @moneymatters. Copyright © Bible Money Matters - please visit biblemoneymatters.com for more great content. Related Posts |

| 4 Ways In Which We Are Typically Overinsured Posted: 04 Apr 2011 05:20 AM PDT I was speaking to someone the other day about how the average American is extremely focused on financial safety and protection. That then made me think about the proliferation of insurance policies that exist! While it is usually a financially responsible thing to have insurance, there also exists a chance of being overinsured! Ways In Which We Are Overinsured:Renting A CarWhenever you attempt to rent a car, you are presented with the option (usually presented as an obligation) of purchasing a damage/liablity waiver as well as other forms of insurance. Most of us automatically think of what would happen if the rental car was damaged while in our possession! Not wanting to pay out thousands of dollars to fix a car that we do not own, we immediately jump on the offer to buy the rental company’s coverage. However, we may already have this coverage available to us based on existing financial relationships. Many credit cards will offer some form of coverage to insure against damage done to rental cars. Usually, the only “catch” is that you have to rent the car using that credit card. Just be sure to call your credit card company a few days ahead of your planned rental to ensure that the coverage is adequate for your needs. Also, if you currently have auto insurance, you may be covered for your rental car as well. Check through your policy details to see if you have this coverage available. If you are unsure about anything that you have read, place a quick call to your insurance company. If you pay for rental cars often, being overinsured can cost you or your company a lot of money! Emergency Roadside AssistanceMany people pay annual fees to companies like AAA, Paragon Auto Club, and National Automobile Club, to insure us in case we need mechanical assistance on the road. This usually includes flat tire repair, jumpstarting a dead battery, towing, auto locksmiths, fuel delivery (just enough to get you to a gas station or home) and other basic services that can leave us stranded on the road. What I have found is that many auto insurance policies already include these features! That means that there are a lot of people out there who are overinsured when it comes to roadside assistance. Extended Warranties/Purchase ProtectionThis is another area that is becoming big business. Extended warranties used to be pushed when someone purchased a big ticket item such as a big screen TV or a used car. However, I have noticed that even less expensive electronics and appliances are being sold with the option to add an extended warranty. There are two ways in which we can be overinsured by purchasing an extended warranty. The first is failing to take advantage of the manufacturer’s warranty. Many products are sold with a manufacturer’s warranty, which covers the item against most types of product failures. Depending on the item, you may be able to bring it to a nearby store, or even have a certified repairman come to your home – all for free! So, before you make a purchase, be sure to check with the manufacturer to see if they offer a warranty on the item. The second way in which we can be overinsured is by failing to recognize the coverage that our credit card provides. Most credit cards provide purchase protection, which helps you to guard against buying an item that turns out to be a lemon, and having a seller who doesn’t want to issue a refund. This may be helpful if/when you don’t trust the manufacturer to back their warranty. On top of having purchase protection, some credit card issuers offer their own extended warranty at no extra charge. Call your various credit card companies to see exactly what type of credit card benefits are available on your purchases. Life InsuranceHaving life insurance is a must for most people who have an income (or whose death would greatly affect another’s ability to earn an income). Therefore many people have made it a priority to purchase life insurance. However, this could lead to being overinsured as well. Some employers offer life insurance as a part of their benefits package. Since the employer purchases this coverage as a part of a group policy, they are able to get much lower benefits than an individual. In many case, the employer will subsidize most of all of the monthly premium. Because of this, it is usually much cheaper to purchase life insurance through your employer rather than on your own. The major consideration that must be made in this case is the coverage threshold. These policies typically pay out a multiple of two or three times your annual salary. Therefore, while you might not be able to cancel your individual policy, you can reduce it by the amount of your employer’s coverage. Reader Questions

This article was written by Khaleef Crumbley. Khaleef founded KNS Financial in order to assist people with financial matters in a more organized and systematic way. KNS Financial provides Personal Financial advice, Budgeting Assistance, Tax Preparation and Advice, Debt Management, and Economic Commentary. He also writes for the Faithful With A Few blog where he seeks to help Christians understand how to manage their finances in a way that honors God. Be sure to subscribe in order to keep up with Khaleef's writing. Copyright © Bible Money Matters - please visit biblemoneymatters.com for more great content. Related Posts |

| You are subscribed to email updates from Bible Money Matters To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Tidak ada komentar:

Posting Komentar